arizona real estate tax rate

Find Out the Market Value of Any Property and Past Sale Prices. From the amount you will make from the house sale.

Arizona Property Tax Calculator Smartasset

1099 17th lowest Median home value.

. Arizona is one of only fourteen states that dont have to struggle with real estate transfer taxes on residential properties. The average effective tax rate in the state is 062 which is well below the 107 national average. Arizona state income tax.

The average effective tax rate in the state is 062 which is well below the 107 national average. Arizona voters went to the polls in November 2008 and bid overwhelmingly in support of a constitutional amendment to ban. Per capita property taxes.

Property taxes are usually billed in two installments. 59246 24th lowest Every year Arizona homeowners pay an average of 067 percent of their property value in taxes making it one of the lowest effective property tax rates in the country. The average effective property tax rate in Arizona is just 062 well below the national average.

Does Arizona have property tax. Arizona state income tax rates range from 259 to 450. Is Personal Property Taxable.

42-18054A 1 and 2. The effective real estate tax rate across the state is 072 which means that the annual tax youll owe on a median-priced house comes out to about 1398. 1 of each year.

As Percentage Of Income. You can look up your recent appraisal by filling out the form below. 241100 19th highest Homeownership rate.

Arizona property tax rates vary according to certain factors such as your city county school district and whether your house is in any special tax. The total amount that will be billed in property taxes. Arizona Department of Revenue.

Money from property tax payments is the lifeblood of local community budgets. View more information on Arizonas personal property tax in Publication 545 and the annual Personal Property Manual. Arizona 85003 Main Line.

If your home is assessed at 200000 and your property taxes were exactly 13 then youd be paying 2600 per year in. 1 and the remainder due the following March 1. While maintaining constitutional restrictions mandated by law Phoenix enacts tax rates.

Ad Find Your County Online Property Taxes Info From 2022. Apart from the county and districts like schools many special districts like water and sewer treatment plants as well as transportation and safety services depend on tax money. A property tax bill can be paid electronically or by mail to the County Treasurer of the county in which the property is located.

You can calculate your take home pay using our Arizona paycheck calculator. Arizona property taxes are due Oct. Income tax rates in Arizona range from 259 450.

What Are Arizona Real Estate Taxes Used For. The state of Arizona has relatively low property tax rates thanks in part to a law that caps the total tax rate on owner-occupied homes. From the total purchase cost of the home subtract the amount you spent on renovations closing costs agent fees etc.

The tax rate applicable to each parcel of property is the sum of the state county municipal school and special district rates. 648 13th lowest Median household income. Sales tax statewide is 56 and local rates average 28.

Effective Real-Estate Tax Rate. The tax rate is calculated based on the tax levy for each taxing authority and assessed values by the County Assessor. There is however quite a large difference in how much Arizona residents pay.

Arizona does not have a property tax on household goods or intangible personal. The average tax rate on homes in Arizona before exemptions and rebates is typically somewhere between 87 and 15 of market value. If your tax due is over 100 half is due Oct.

Learn Arizona tax rates for property sales tax to estimate how much youll pay on your 2021 tax return. 52 rows Here is a list of states in order of lowest ranking property tax to highest. 5 rows Arizona state income tax rates are 259 334 417 and 45.

The median property tax in Arizona is 135600 per year based on a median home value of 18770000 and a median effective property tax rate of 072. The rates for long-term capital gains taxes are 0 15 and 20 depending on the tax bracket the owner claimed while filing their tax return for that year. Reserved for the county however are appraising property mailing billings performing collections carrying out compliance and dealing with disagreements.

How do I calculate my capital gains. Owners rights to timely notice of tax levy raises are also required. Arizona Property Tax Rate.

Where Can You Go For More Information. 1600 West Monroe Street. If a property is mortgaged the property taxes are typically paid by the mortgage holder.

Arizona Property Tax Calculator Smartasset

State Corporate Income Tax Rates And Brackets Tax Foundation

States With Highest And Lowest Sales Tax Rates

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Arizona Property Tax Calculator Smartasset

Maricopa County Assessor S Office

Maricopa County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

2022 Property Taxes By State Report Propertyshark

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Property Taxes In Arizona Lexology

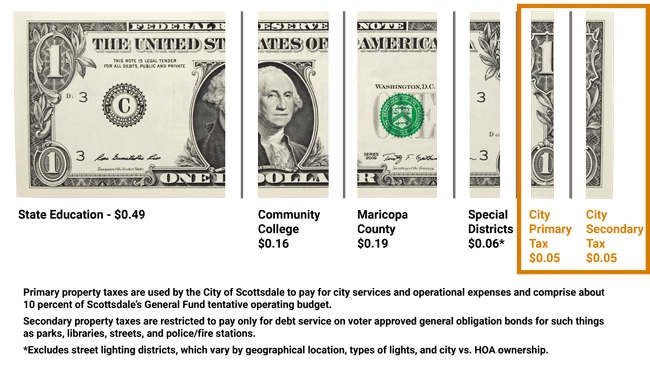

City Of Scottsdale Truth In Taxation Notice

Arizona State Taxes 2021 Income And Sales Tax Rates Bankrate

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Property Taxes How Much Are They In Different States Across The Us