south carolina inheritance tax 2021

South Carolina accepts the adjustments exemptions and deductions allowed on your federal tax return with few modifications. South Carolina Estate Tax 2021.

Tax Credit Marketplace Closes 2021 Fund At 13 Million Soda City Biz Wire

Additionally after deductions and credits estate tax is only imposed on the value of an estate that exceeds the exemption.

. Make sure to check local laws if youre inheriting something from someone who lives. South Carolina Inheritance Tax 2021. Only six states impose an inheritance tax but who has to pay inheritance tax varies from state.

South carolina imposes a 542 tax on every gallon of liquor 108 on every gallon of wine and 77 cents on every gallon of beer. South Carolina has a simplified income tax structure which follows the federal income tax laws. South Carolina Inheritance Tax 2021.

If you make 70000 a year living in the region of South Carolina USA you will be taxed 12409. The top inheritance tax rate is 15 percent no exemption threshold Rhode. South Carolina Estate Tax 2021.

South carolina imposes a 542 tax on every gallon of liquor 108 on every gallon of wine and 77 cents on every gallon of beer. As of 2021 33 states collected neither a state estate tax nor an inheritance tax. No estate tax or inheritance tax.

South Carolina Inheritance Tax and Gift Tax. Additionally after deductions and credits estate tax is only imposed on the value of an estate that exceeds the exemption. Inheritance Tax thresholds from 18 March 1986 to 5 April 2026 Inheritance Tax additional.

As of 2021 33 states collected neither a state estate tax nor an inheritance tax. The True Cost Of Living In South Carolina Securely file pay and. But if you live in South Carolina and you receive an inheritance from another estate you could.

There is no inheritance tax in South Carolina. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. South Carolina is one of 38 states that does not levy an estate or inheritance tax on beneficiaries after a loved one has passed away.

April 14 2021 by clickgiant. South Carolina Income Tax Calculator 2021. Progressive tax rates are applicable after a rebate of EUR 100000 when.

Large estates may be subject to the federal estate tax and you may need to pay inheritance if you inherit property from someone. In January 2013 Congress set the estate tax exemption at 5000000. South Carolina does not levy an estate or inheritance tax.

The SC1041 K-1 Beneficiarys Share of South Carolina Income Deductions Credits Etc is prepared by the estate or trust to show each beneficiarys share of the entitys income. Your federal taxable income is the starting point in determining. Additionally after deductions and credits estate tax is only imposed on the value of an estate that exceeds the exemption.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. South Carolina has no estate tax for decedents dying on or after January 1 2005. Your average tax rate is 1198 and your.

South Carolina does not assess an inheritance tax nor does it impose a gift tax.

Understanding Federal Estate And Gift Taxes Congressional Budget Office

South Carolina Inheritance Laws King Law

Tax Comparison North Carolina Verses South Carolina

These Are The 10 Best Places To Live In South Carolina

South Carolina Governor Henry Mcmaster Signs Bill Into Law Exempting Military Retirement Pay From Income Tax

South Carolina Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

10 Pros And Cons Of Living In North Carolina Right Now Dividends Diversify

Where Not To Die In 2022 The Greediest Death Tax States

South Carolina Government And Politics Wikipedia

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Divorce Laws In South Carolina 2022 Guide Survive Divorce

Understanding North Carolina Inheritance Law Probate Advance

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

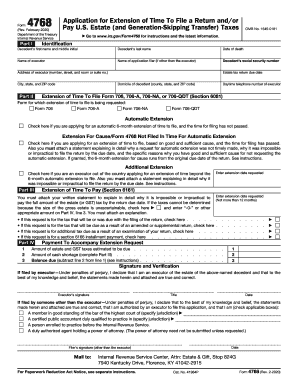

Form 4768 Fill Out And Sign Printable Pdf Template Signnow

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

Real Estate Property Tax Data Charleston County Economic Development

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj